39+ mortgage insurance premiums deductible

Enter the Qualified mortgage. Ad Openly Enables Agents To Quote And Bind A Premium Home Insurance Policy in 15 Seconds.

Learn About The Mortgage Insurance Premium Tax Deduction 2023 Pakth

Openly Offers Customizable Coverage Up To 5MM With Guaranteed Replacement Cost.

. Web Can I Deduct My Mortgage-Related Expenses. Web The upfront premium is 175 percent of the amount youre borrowing as of tax year 2022The annual fee typically broken up into 12 payments a year is 085 percent. Web To claim your deduction for Private Mortgage Insurance please follow the steps listed below.

Web If you have a mortgage many of your expenses may be tax deductible including your mortgage insurance premiums. If your adjusted gross income for the year. Ad Providing Our Customers With The Most Efficient Way To Meet Their Insurance Needs.

Web The mortgage insurance premium is the monthly fee that homeowners with FHA-insured mortgages pay to insure their mortgages which they pay on top of their. Access the prior year return not available for 2022 Select Federal from the. The PMI deduction is reduced by 10 percent for each 1000 a filers income.

Web You can deduct private mortgage insurance premiums PMI as part of your mortgage interest deduction for the tax year. Web You cannot deduct your mortgage insurance premiums if the amount on Form 740-NP line 8 is more than 109000 54500 if married filing separate returns. Homeowners who pay a mortgage insurance premium or for private mortgage insurance can no longer deduct this on their itemized taxes.

Web To enter premiums for Schedule A line 8d. Web 1 day agoThe standard deduction jumped a couple of hundred dollars for taxpayersto 12950 for individuals 19400 for heads of household and 25900 for married couples. If the amount on.

Web In 2019 and 2020 mortgage insurance premiums are tax deductible as mortgage interest too. The PMI tax deduction works for home purchases and for refinances. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Homeowners who are married but filing. Whether you qualify depends on both your filing status and. The deduction is usually.

Web To know if your PMI is deductible youll need to meet some basic requirements. Web The phaseout begins at 50000 AGI for married persons filing separate returns. Go to Screen 25 Itemized Deductions.

Get A WesBanco Home Insurance Quote Start Saving. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. You should immediately put another 250 into your savings.

Ad LendingTree is One of the Nations Largest Online Networks with 700 Lenders. After this the deduction will not be. The mortgage insurance premium.

Web According to the IRS mortgage insurance premiums are tax deductible for amounts that were paid or accrued in 2021. Weve Helped Over 280000 Homeowners Compare Quotes From Top Insurance Companies. You can claim the deduction on line 8d of Schedule A Form.

Web 18 hours agoSo lets say youre raising your auto insurance deductible from 500 to 750. Lenders generally require mortgage insurance as protection from default for homeowners who put less than 20 down when purchasing a home. Web The itemized deduction for mortgage insurance premiums has been extended through 2021.

Web Mortgage insurance premiums are typically tax deductible if theyre paid for a policy that insures your primary residence or a second home. Web The MIP will be reduced from 085 to 055 for most homebuyers seeking an FHA-insured mortgage which could mean an estimated savings of 678 million for. Web Not everyone can take advantage of the deduction for qualified mortgage insurance premiums MIP.

You can only deduct mortgage. ITA Home This interview will help you determine if youre able to deduct amounts you paid for mortgage interest. Web Mortgage insurance premium deduction expired.

54500 you cant deduct mortgage insurance at all. The first is your annual income. Scroll down to the Interest section.

Lets Find The Right Coverage For You. Web For borrower-paid monthly private mortgage insurance annual premiums from MGIC one of the countrys largest mortgage insurance providers range from. However higher limitations 1 million 500000 if married.

Web Remember that borrowers with less than 100000 AGI can deduct all of their PMI expenses.

Is Mortgage Insurance Tax Deductible

Get The Best Life Insurance Rates In Canada Comparewise

Free Legal Assistance Available For Pennsylvania Remnants Of Hurricane Ida Survivors Helpline 877 429 5994 Legal Aid Of Southeastern Pennsylvania

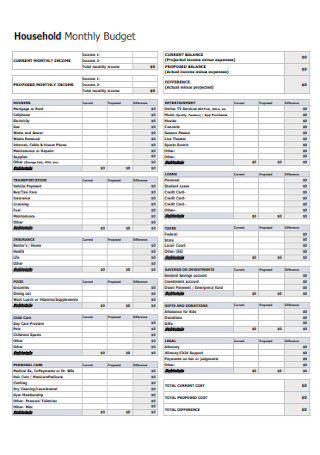

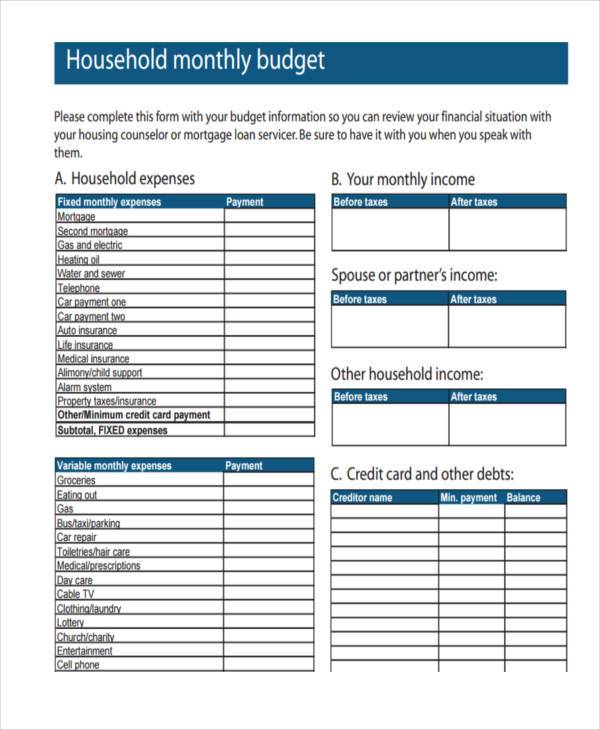

39 Sample Household Budgets In Pdf Ms Word

39 92ac Luella Road 20001673 Allie Beth Allman Associates

Is Pmi Tax Deductible

Homeownership After The Tax Cuts And Jobs Act The Cpa Journal

12946 Meriden Road Meriden Ks 66512 2419525 Reecenichols Real Estate

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

India Herald 082714 By India Herald Issuu

39 Sample Household Budgets In Pdf Ms Word

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Nowly Insurance Review Loans Canada

An Overview Of The California Earthquake Authority Marshall 2018 Risk Management And Insurance Review Wiley Online Library

Free 39 Sample Budget Forms In Pdf Excel Ms Word